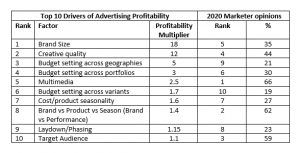

The advertising multipliers that matter are not what marketers think

New analysis on the key factors of advertising profitability is contrasted against marketers’ views of the most important factors – and marketers aren’t focusing in the right areas.

I’ve just completed a fascinating collaboration with the econometric guru Paul Dyson which reviews a ranking of the key factors that impact advertising profitability, together with an indication of the relative importance of those factors (multipliers*). Unfortunately, it seems that not all advertisers are concentrating their energies and budgets in the right areas to make advertising as profitable as it can be.

The collaboration used insights from Kantar’s brand, media and creative databases to enhance Paul’s previously published profitability measures from market mix modelling, and we then contrasted these empirical learnings with responses to a new survey question asked among global marketers: “which factors do you think best maximise your absolute ROI?”

As you can see in the table below, marketers generally tend to over-estimate the relative importance of media mix allocation, balancing brand vs performance marketing, and targeting, while they tend to under-estimate the importance of brand size, creative quality and budget setting across geographies and portfolios.

Brand size is massively important because bigger brands get much better absolute returns on their advertising. “Small” brands in a high value category (such as automotive, finance or travel) could easily have a bigger annual turnover (and therefore advertising ROI) than a “large” brand in a low value category. Of course, brand size is inextricably linked to brand health, or “power”. Kantar research has consistently shown that stronger, more meaningfully different brands are more likely to grow. In particular, we know that brands with strong difference are especially likely to see higher advertising returns.

Second only to the size and strength of brand is the quality of the advertising itself. There can be dramatic differences between the efficacy of the best and worst ads. Many award-winning ads are not easily linked to the brand, and others have a shock factor but fail to trigger the right emotional response. The best ads manage to combine being both creative AND effective.

Optimising the media mix can pay major dividends, both in terms of how much brands invest in individual media channels (e.g. TV vs OOH vs online), and how much is invested in specific formats and placements (e.g. online display vs online video, Facebook vs YouTube etc.). However, the relative opportunity to improve profitability through mix optimisation is smaller than ensuring you have invested money in brands with high potential returns, and ads which work.

Since the media multipliers which actually drive profitable returns don’t seem to align as they should with marketer priorities, we hope this serves as a useful reminder of why CMOs and media managers need to continually question how their media investment decisions are being made.

*The profitability multiplier is calculated on advertising profitability (sales from advertising minus cost of advertising). This is a better measure than ROI (sales from advertising divided by cost of advertising) which can be affected by budget size and diminishing returns making cross comparisons difficult. The multiplier is intended to give an idea of the typical range of impact of that factor on profitability (i.e. the ratio of the absolute return which “optimal” brands score on each factor, in comparison to the “worst”).